Last Updated: April 20, 2023, 11:18 IST

NCP spokesperson, who was contacted by News18.com, said Ajit Pawar has never shied away from investigation. (Photo: ANI File)

Jarandeshwar Co-operative Sugar Mill Ltd became operational in the year 1999-2000 during which it obtained loans from MSCB from time to time, when Ajit Pawar was on the bank’s board of directors.

There was a buzz in Maharashtra on Tuesday about a split in the Nationalist Congress Party (NCP), with speculations being raised that 40 MLAs have extended support to the leader of opposition in Vidhan Sabha Ajit Pawar and that he would soon join hands with the Bharatiya Janata Party (BJP).

However, later in the day, Pawar clarified that he was not leaving NCP, “not until his last breath”.

While these rumours of cracks in the NCP and Pawar supporting the BJP have been rife for a while now, what is also being spoken about is the role of Ajit Pawar and his company in Jarandeshwar Sugar Mills.

The Enforcement Directorate (ED) had in 2019 registered an Enforcement Case Information Report (ECIR) pertaining to illegal allocation of sugar mills and the role of district Co-operative banks in providing loans to them. ED is investigating this money laundering case where charges have been levied under sections 120 (B), 420, 467 and 471 of the Indian Penal Code.

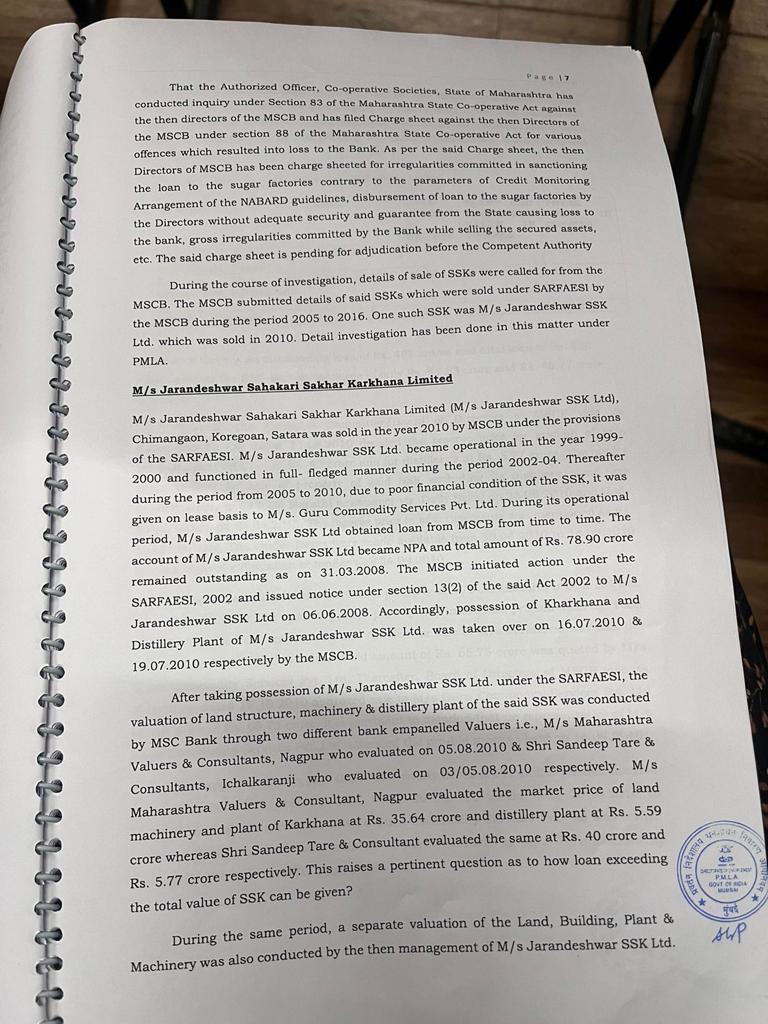

According to the ED’s charge sheet, there have been irregularities in disbursing loans to sugar factories by Maharashtra State Co-operative Bank (MSCB), which is contrary to the credit management guidelines by NABARD.

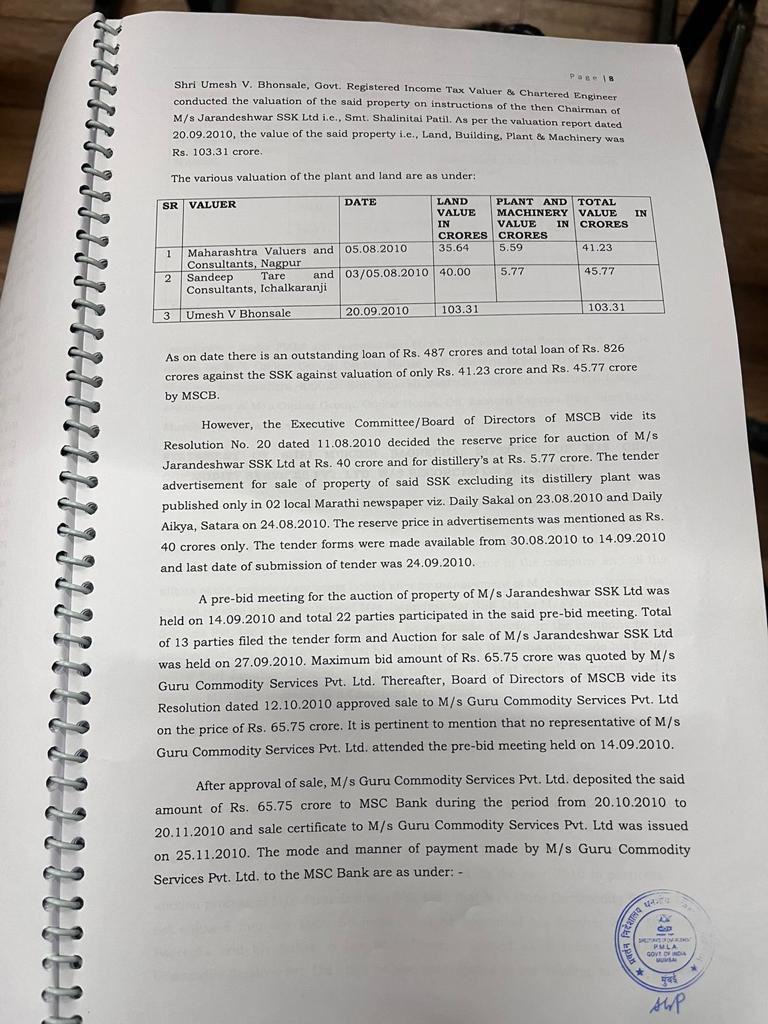

The charge sheet also adds that as on date there is an outstanding loan of Rs 487 crore and a total loan of Rs 826 crore against the sugar mills against valuation of only Rs 41.23 crore and Rs 45.77 crore by the MSCB.

What is the actual story?

Jarandeshwar Co-operative Sugar Mill Ltd became operational in the year 1999-2000 during which it obtained loans from MSCB from time to time, when Ajit Pawar was on the bank’s board of directors.

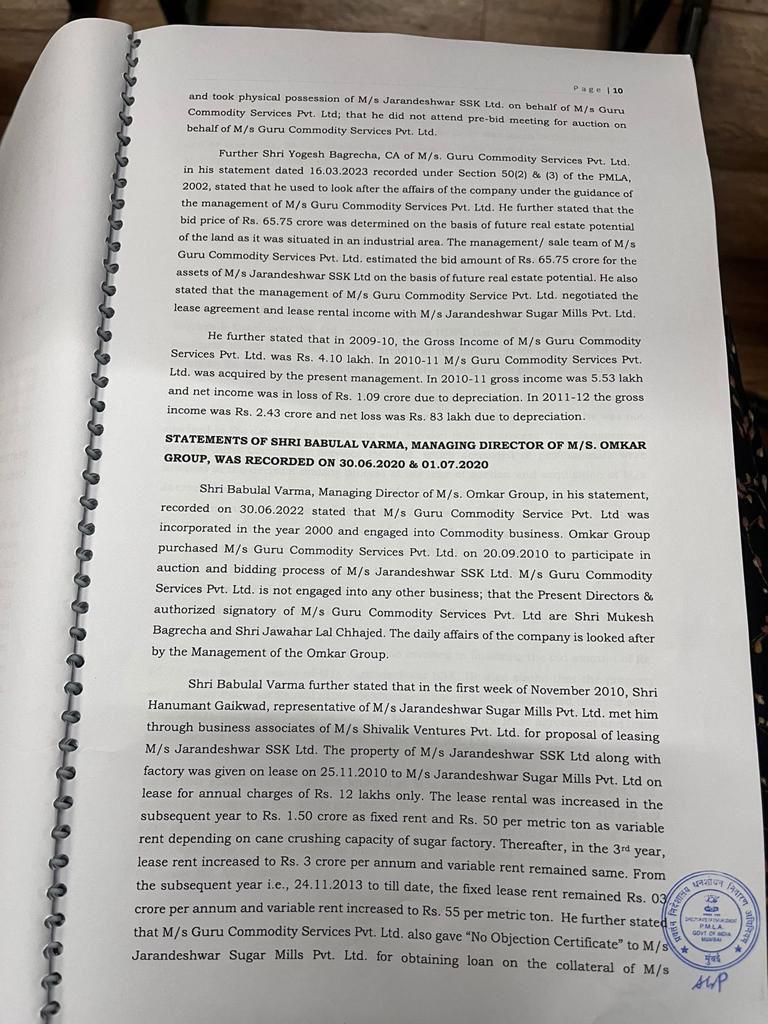

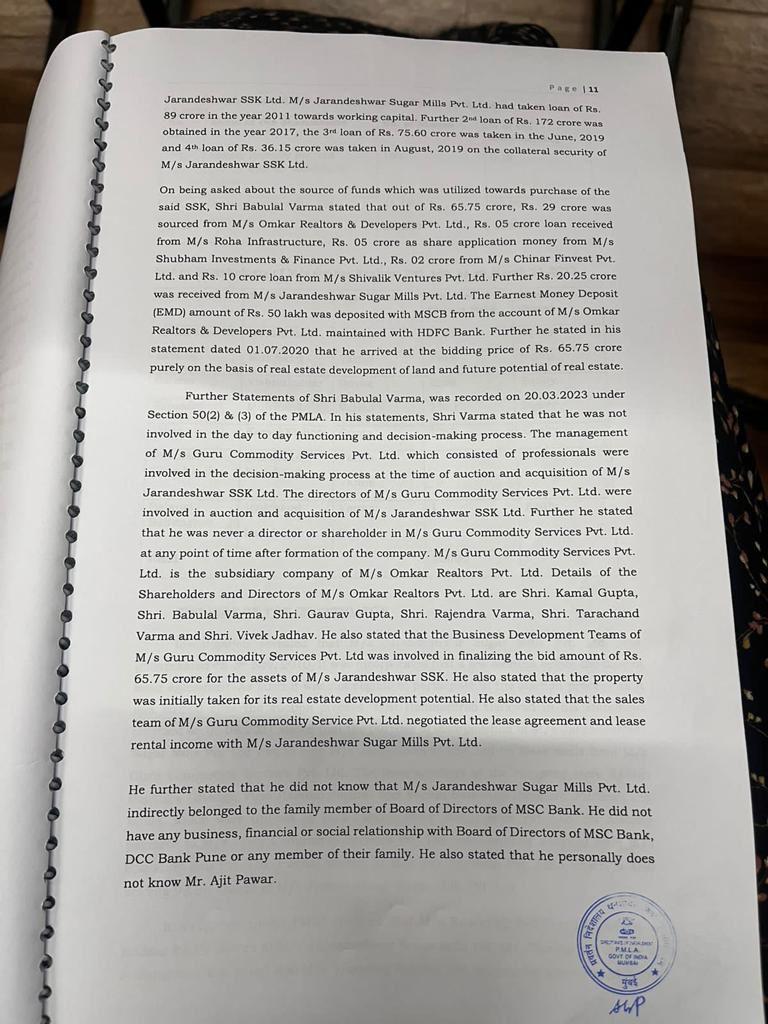

The account became a Non-Performing Asset (NPA) and a total amount of Rs 78.9 crore remained outstanding. MSCB sold the mill to Guru Commodity Services in 2010 through an auction. A company with the same name, Jarandeshwar Sugar Mills Pvt Ltd, incorporated in November 2010, which took the mill on lease from Guru Commodity Services, was controlled by a holding company where Ajit Pawar was a former director.

After the auction, an Rs 826 crore loan was availed in the name of the mill from Pune District Central Co-operative Bank (headed by Ajit Pawar) and other banks, but the money was diverted for various other purposes.

Why are these parallels being drawn to Ajit Pawar?

In 2019, when a one-and-half-day coalition was formed between BJP and NCP, wherein Devendra Fadnavis was sworn in as Chief Minister and Ajit Pawar became the Deputy Chief Minister, there were media reports that Pawar had gotten a clean chit in the irrigation scam.

The scam dates back to the time when Pawar was the irrigation minister in Maharashtra during the Congress-NCP government. Pawar was alleged to be at the helm of irregularities in projects awarded by his ministry. The allegations included claims that Ajit Pawar awarded projects at inflated prices. Allegedly, it was a Rs 70,000 crore scam and Pawar cleared cost escalations of 32 irrigation projects.

What does NCP have to say on this?

NCP spokesperson, who was contacted by News18.com, said Pawar has never shied away from investigation.

“If called by the agency or if the agency wants to question Ajit Pawar or know any details from him, he has always cooperated with the investigation and will always do so in the future as well,” said the spokesperson.

Read all the Latest India News here